average cost of errors and omissions insurance

Insurance Business Magazine also estimated that the average cost to a professional of resolving such claims was 22000 excluding the cost of hiring an attorney. Enter Zip Save Up to 75.

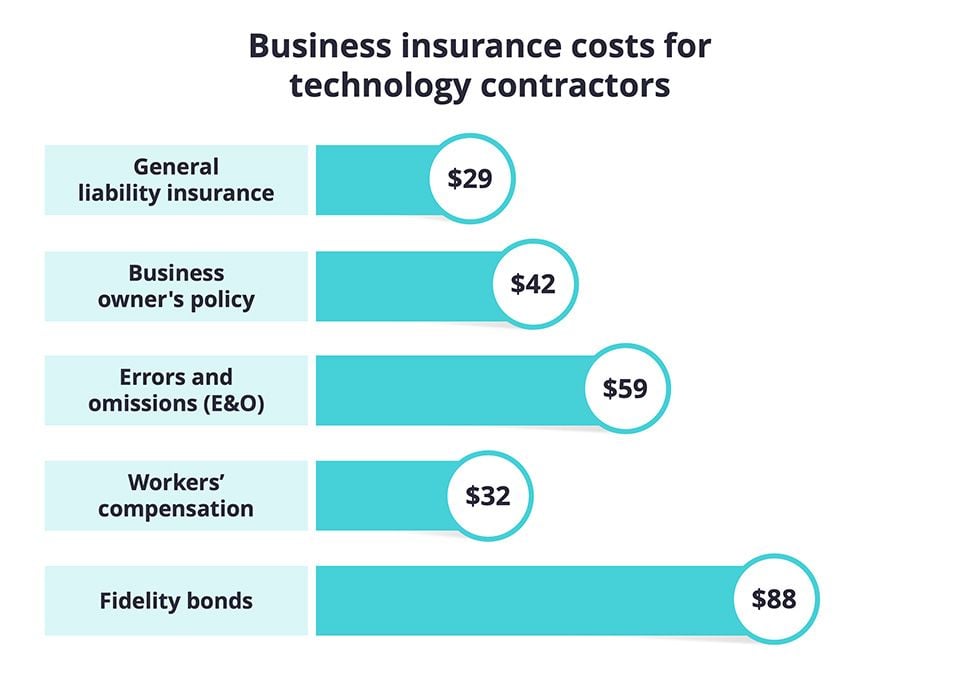

How Much Does Independent Contractor Insurance Cost Techinsurance

Every errors and omissions insurance.

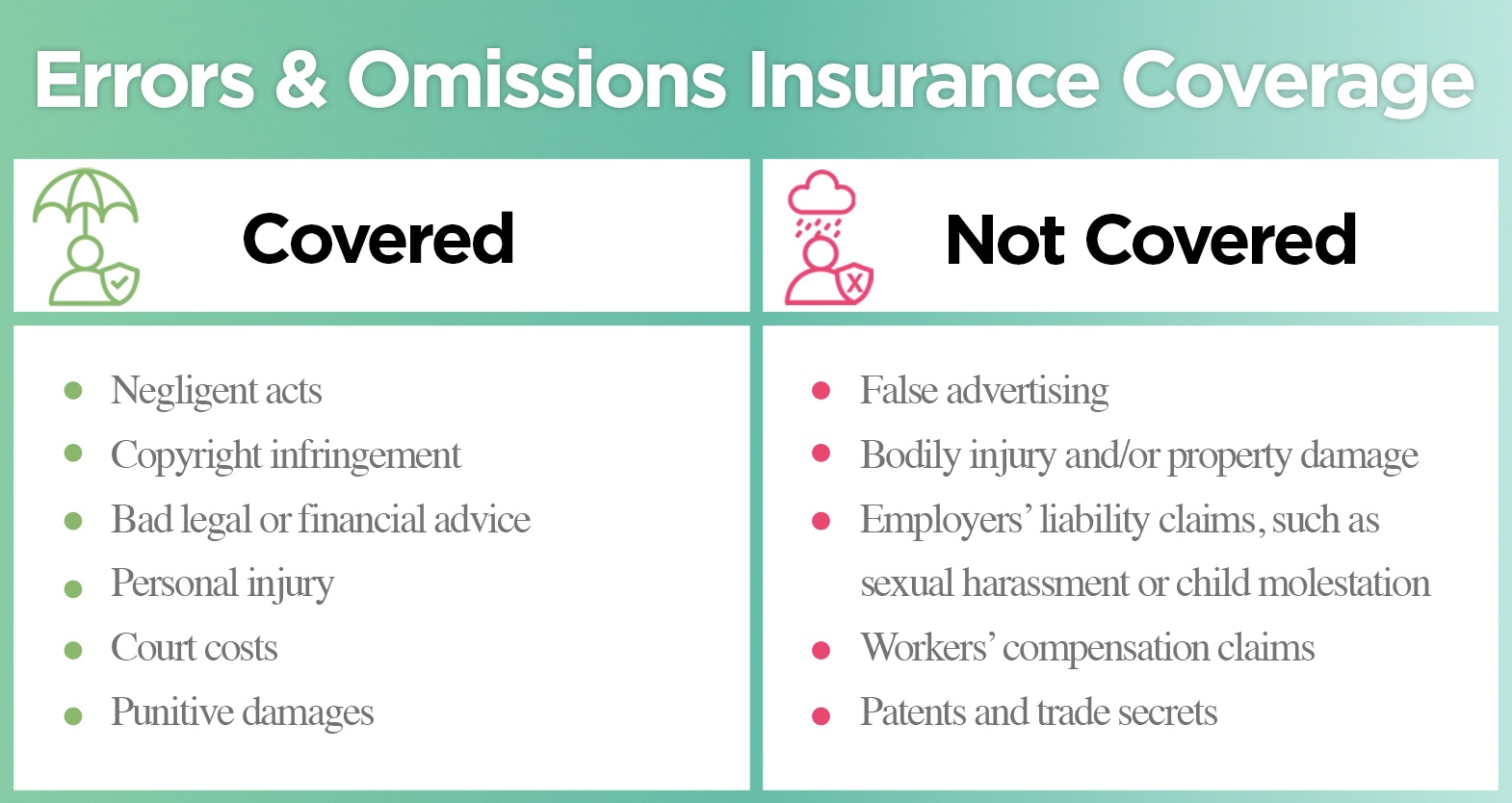

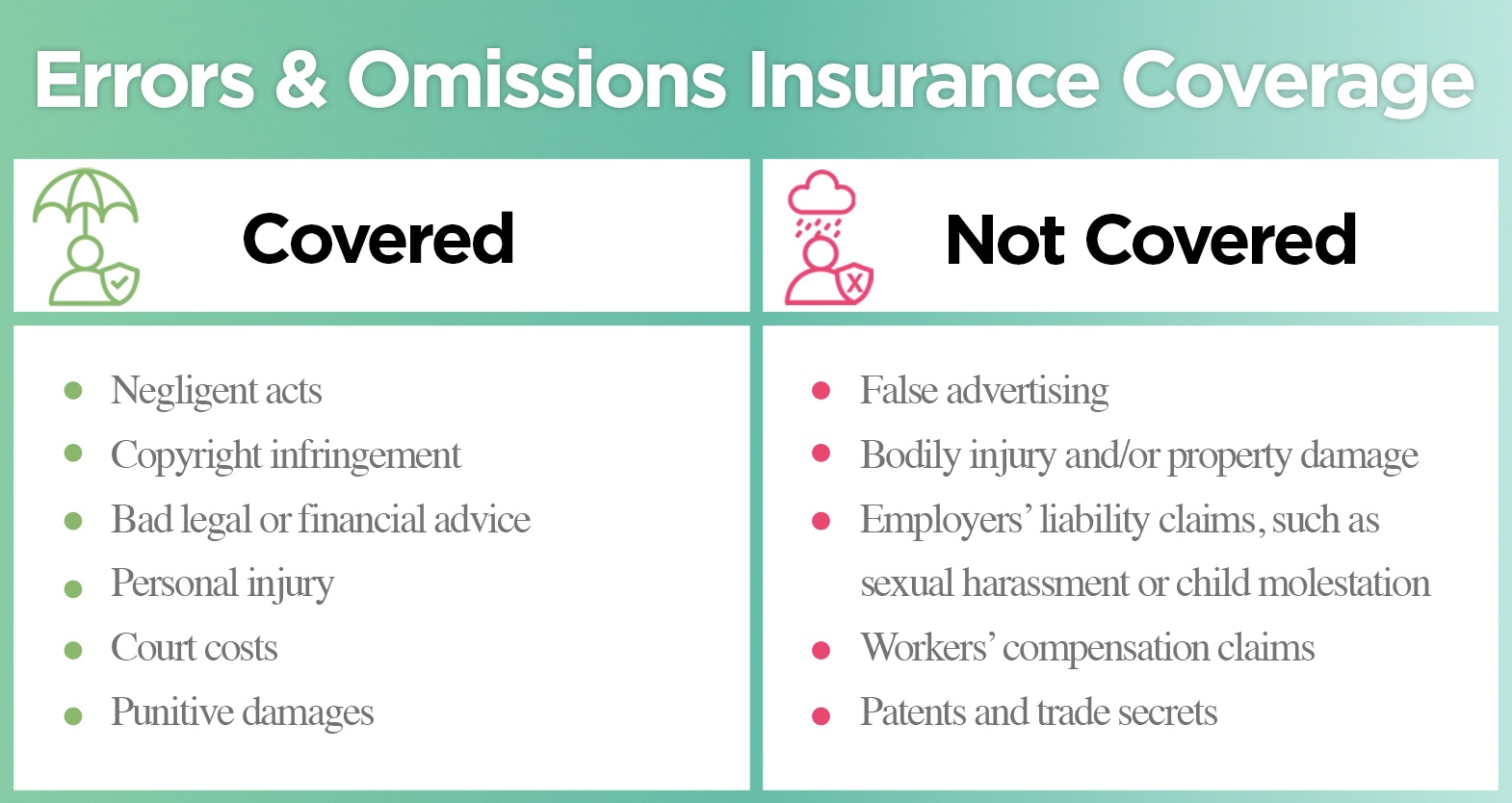

. Errors and omissions insurance helps protect your business from claims of. Ad Compare Errors and Omissions Insurance Quotes For New Jersey. Errors and omissions insurance EO is a type of professional liability insurance that protects companies and their workers or individuals.

We Pride Ourselves in Being Business Insurance Geeks. 2 The amount a company pays depends on various factors including. That is quite reasonable considering how much protection it.

The 10 Factors Influencing The Cost of Errors and Omissions Insurance Coverage. So if your business has 50 employees you can estimate your. A typical EO policy will.

Weve helped our customers. Ad Insurance Agents RIAs Tax Preparers Tour Operators Captains Dentists More. Because of its expertise in a wide variety of.

Pick What Works For You. Errors and omissions insurance policies cover attorney fees court costs and settlements costs up to the policys limits. The average errors and omissions insurance cost depends on the type of business and the amount of coverage.

Ad Get Coverage Instantly from biBERK. The Average Cost of Errors and Omissions Insurance. Most small businesses pay an annual premium between 500 and 1000 for EO insurance.

On average a small business owner could spend around 250 500 per year for an EO insurance policy. Errors And Omissions Insurance - EO. EO insurance can be highly affordable and well worth the expense to protect your business against potential lawsuits.

Get Errors Omissions Insurance. Common sense business insurance backed by Berkshire Hathaway. This also includes a variety of claims including negligence.

Secure top-rated EO insurance in minutes. Trusted by Thousands of Businesses Nationwide. Ad Life is full of surprises- our policy is not.

Talk To An Insurance Agent Now. We Pride Ourselves in Being Business Insurance Geeks. The size of the business the location of the business and the.

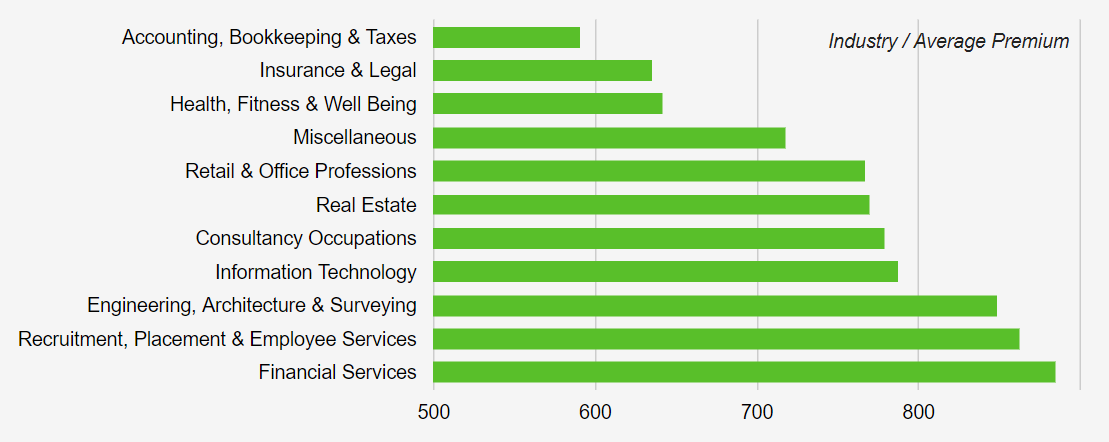

At Bizinsure we analyzed data from more than 5000 of our customers showed that regardless of the industry or policy limits the average yearly cost of Errors Omissions Insurance for a small. Appliance Repair Errors and Omissions Insurance Cost. Talk to Our Trusted Experts.

Average costs for EO coverage for small business owners ranges from 500 to 1000 per employee per year. To receive a quote for errors and omissions insurance. Trusted by Thousands of Businesses Nationwide.

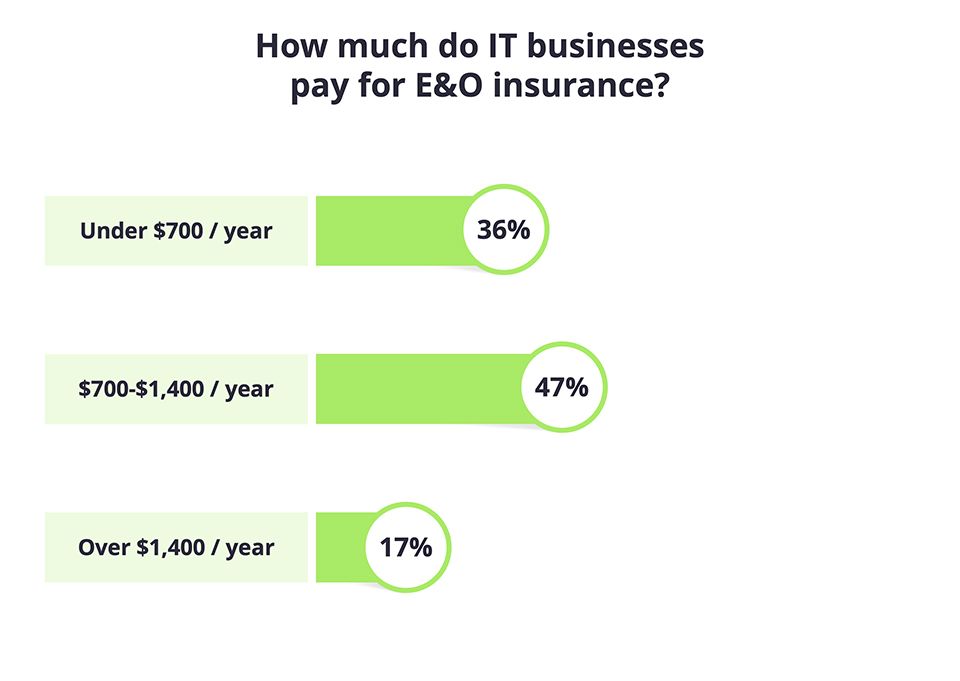

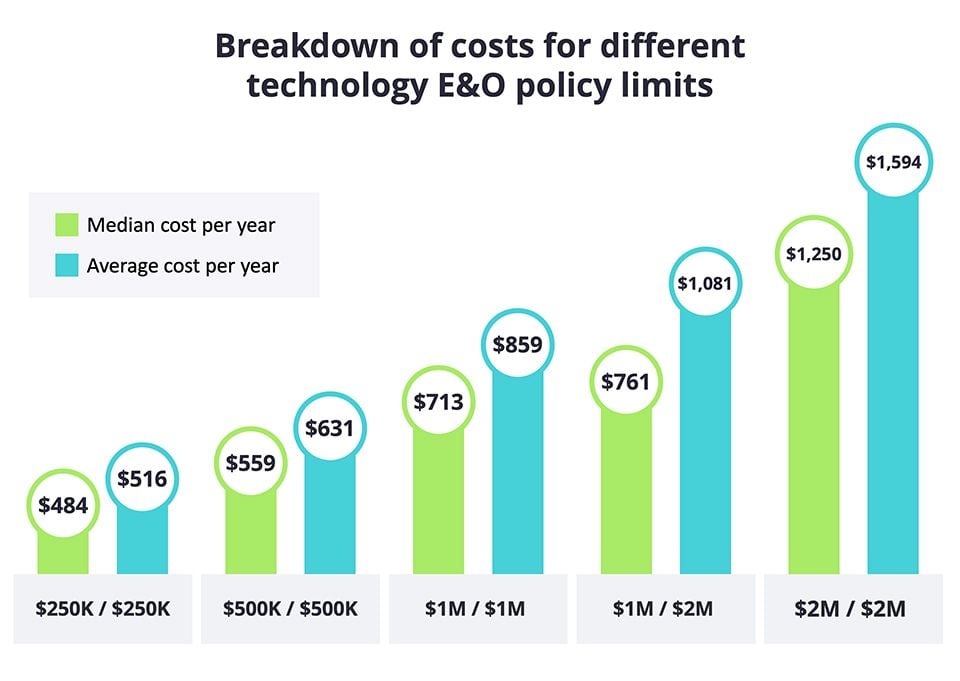

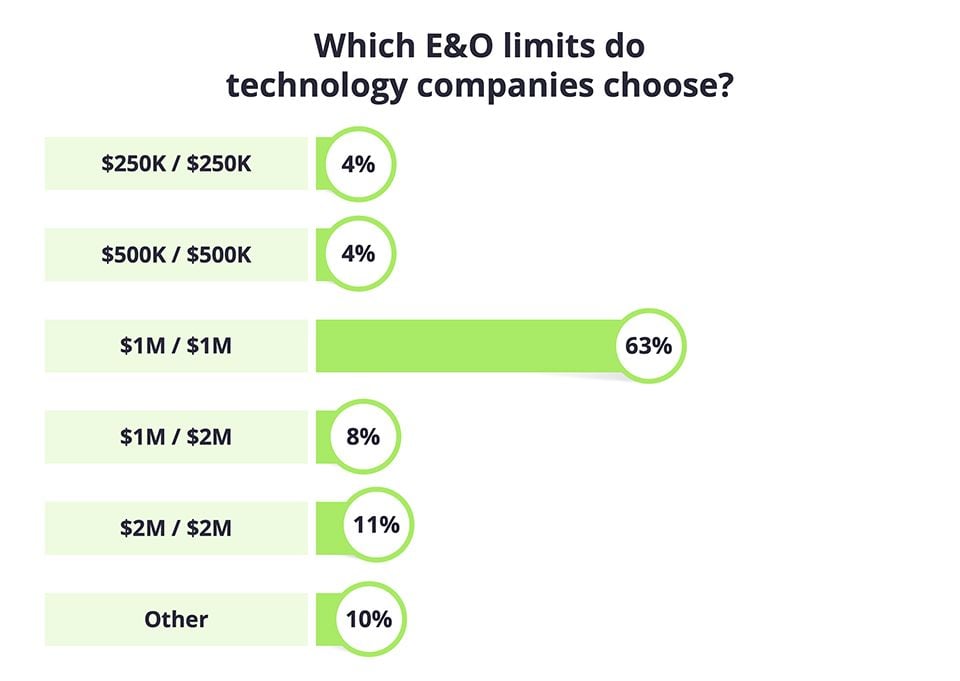

Make Sure Youre Protected From Unexpected Accidents. Most tech businesses buy technology errors and omissions insurance tech EO which bundles EO with cyber liability insurance. Tech EO insurance costs vary from an.

The following factors are typically taken into consideration when determining. On average you should expect to spend between 500 and 1000 per year on an EO policy. The cost of errors and omissions insurance for appliance repair shops and technicians is 2759 per month or 33108 per year.

Instant proof of EO insurance. If someone sues your business for making a mistake in the professional services youve provided this insurance. Ad Get Coverage Instantly from biBERK.

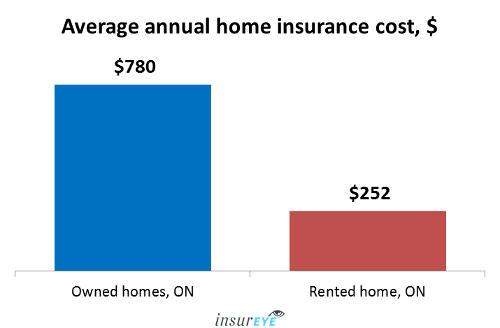

Ad Errors Omissions Insurance Thats Tailored To Your Business. The cost of errors and omissions insurance policy would depend on a wide range of factors like business size day-to-day operations etc. The average cost of an EO insurance policy for an insurance agent is around 65 per month or 780 per year.

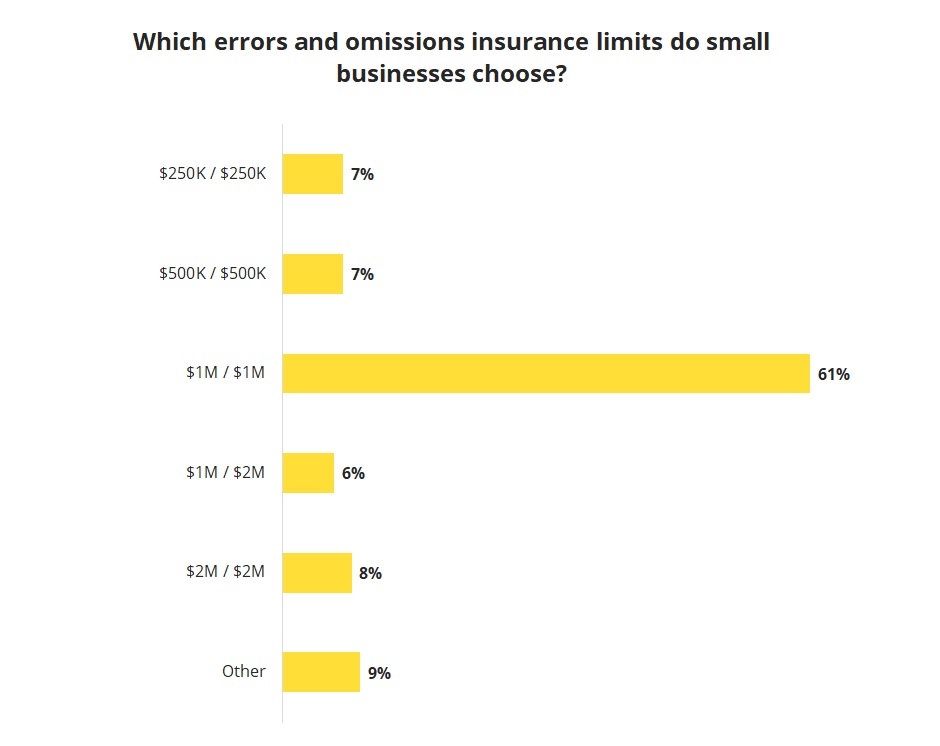

Errors and Omission Insurance is a kind of insurance wherein a professional and the company are insured from the liability that may arise as a result of the claims made against them about. Most small businesses pay between 5001000 per employee per year for errors and omissions insurance landing the average. Talk To Licensed Insurance Agents Today.

Errors and omissions liability insurance often called EO protects your business if you make a mistake or omission when rendering your specialized services. Talk to Our Trusted Experts. Any profession that gives advice or.

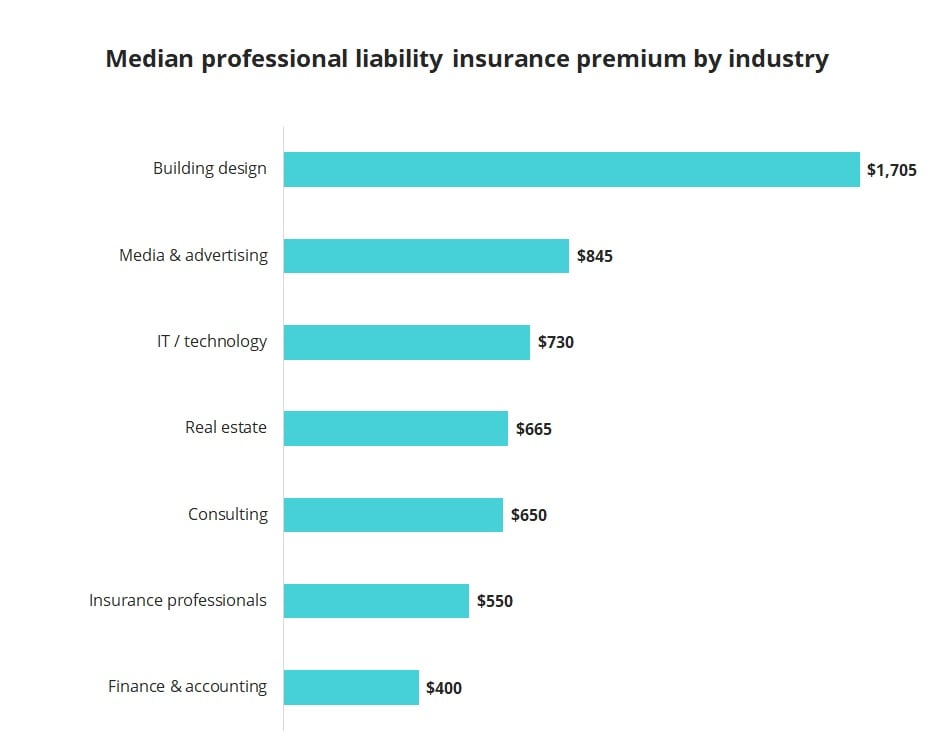

Best and Standard Poors offer Hiscox an A rating which are the third- and sixth-highest ratings on the respective scales. Compare Business Insurance Quotes From Top Providers. How much errors and omissions EO insurance costs varies by profession due to the types of liabilities each profession is exposed to.

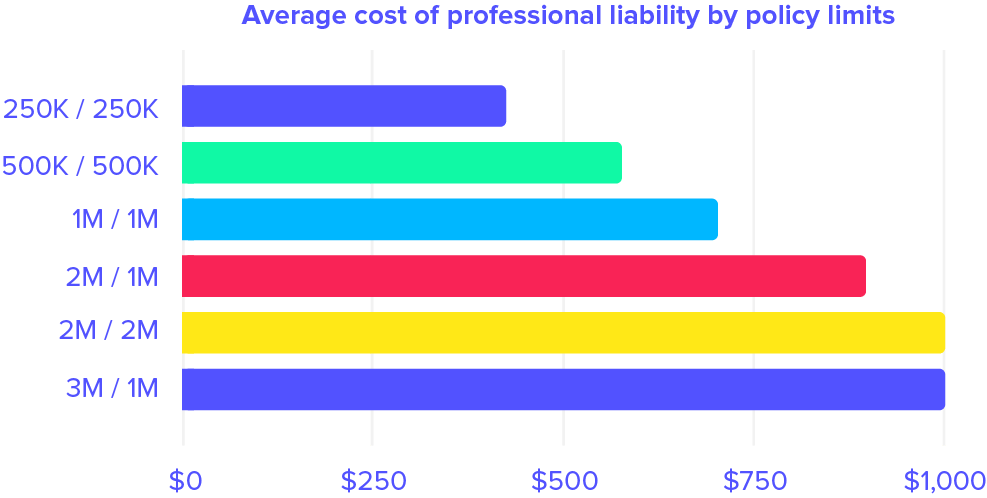

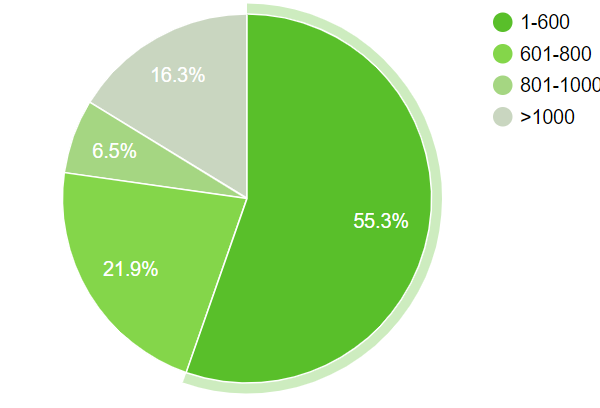

It is important to know how coverage limits work when you are looking for errors omissions insurance. The average individual limit is 1000000. Ad Not Sure Which Policy Is Right For Your Business.

Ad Find Insurance Tailored To Your Business Needs Today. Ad The Fastest Insurance On The Web.

Errors And Omissions E O Insurance Cost Bizinsure

What Does Errors And Omissions Insurance Cost Embroker

Professional Liability Insurance Cost Insureon

How Much Does Errors Omissions Insurance Cost Commercial Insurance

How Much Does Plumber Insurance Cost Commercial Insurance

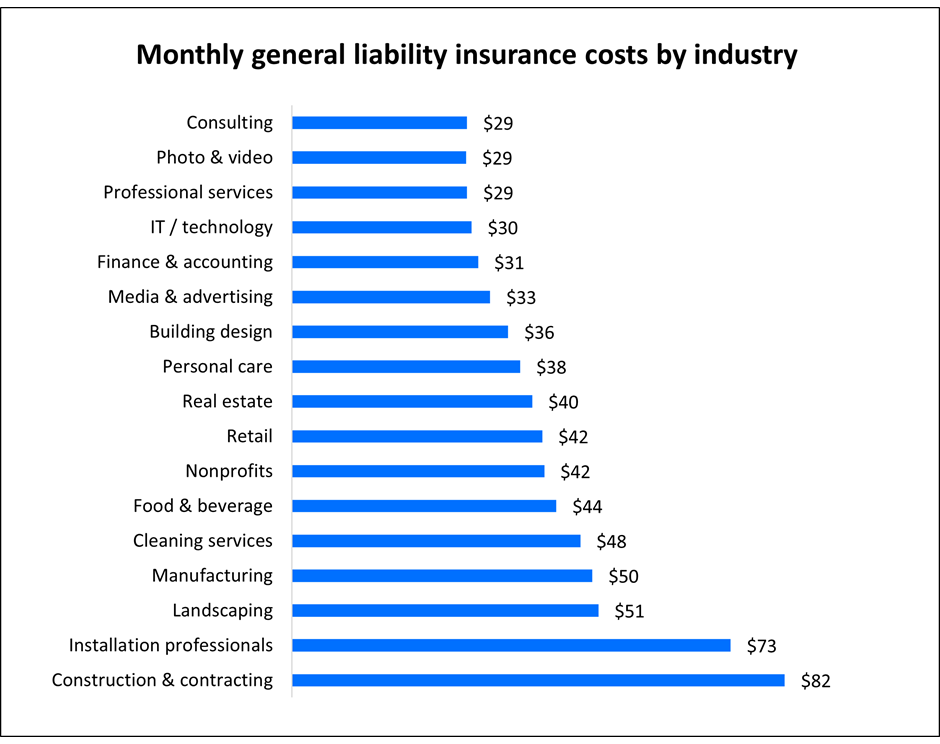

General Liability Insurance Cost Insureon

Smart Apple Insurance Broker Smartapple1 On Mix Insurance Broker Compare Insurance State Insurance

Errors And Omissions E O Insurance Cost Insureon

How Much Is Professional Liability E O Insurance Pogo

Errors Omissions Professional Liability Insurance Cost Techinsurance

Errors Omissions Professional Liability Insurance Cost Techinsurance

The Average Home Insurance Cost In Ontario 780 Year

Errors And Omissions E O Insurance Cost Bizinsure

Errors Omissions Professional Liability Insurance Cost Techinsurance

How Much Does Small Business Insurance Cost Zensurance Study

Errors And Omissions E O Insurance Cost Insureon

Errors And Omissions E O Insurance Cost Insureon

Benefits Of Using Cash Gaming Cheque Services Check People Benefit Finance

How Much Does Errors Omissions Insurance Cost Commercial Insurance

Komentar

Posting Komentar